For most Indigenous entrepreneurs, the road to creating and scaling businesses remains a challenge by long-standing barriers, the greatest being access to capital.

Across Australia, Indigenous businesses rely primarily on two forms of funding: government grants and loans through Indigenous Business Australia (IBA). While these support mechanisms are essential, they also create a cycle of dependency on government, restricting Indigenous businesses from tapping into the broader financial options readily available to non-Indigenous businesses, limiting their ability to build financial independence and achieve true economic self-determination.

The State of Indigenous Business Report 2024 by Supply Nation further outlines the depth of this issue. The report reveals that Indigenous business owners face significant difficulties securing other types of funding, such as bank loans, private investment, and commercial finance. These challenges are deeply rooted in systemic inequality.

Indigenous Australians continue to experience much lower rates of personal savings, home ownership, and inherited wealth, less than half that of non-Indigenous Australians, making it harder to offer collateral when seeking investment. This wealth gap stems from a long history of policies and laws that denied Indigenous people the opportunity to build and pass on financial security.

What makes this funding gap even more striking is the size and success of the Indigenous business sector itself. In 2024, Indigenous businesses contributed an estimated $4.9 billion to the Australian economy. Corporate and government organisations also spent a record $4.6 billion purchasing goods and services from Indigenous-owned businesses, an increase of $500 million from the previous year.

Yet despite this growth, access to private sector funding, such as venture capital, equity investment, or mainstream business loans, remains out of reach for many Indigenous entrepreneurs. Without these funding options, opportunities to scale, innovate, and build long-term sustainability are often limited.

With a thriving sector and a strong and committed customer base, Indigenous entrepreneurs are still largely invisible in Australia's investment landscape.

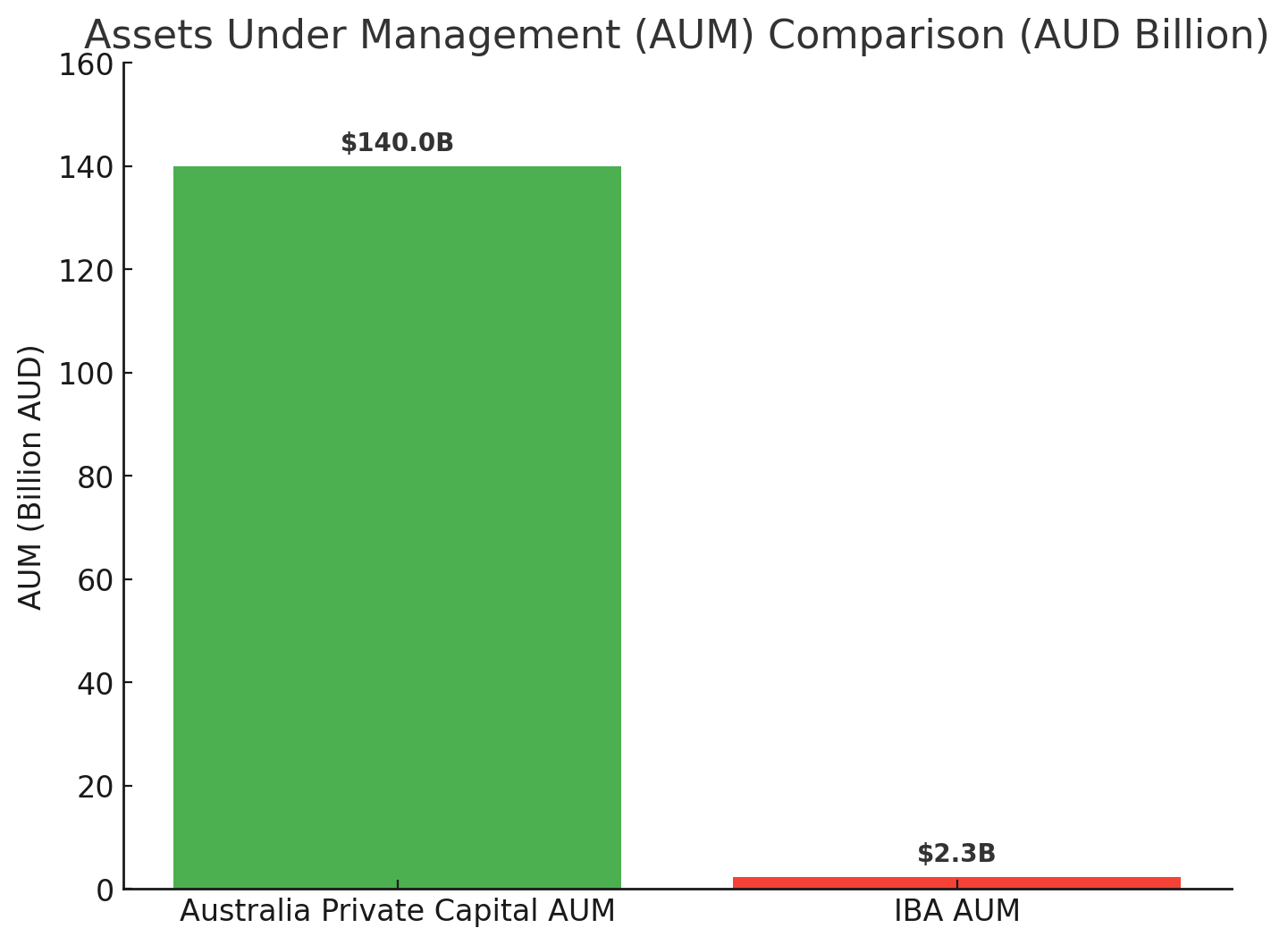

According to the Australian Investment Council's 2024 Annual Report, Australia's private capital industry has seen significant growth, with assets under management (AUM) reaching $140 billion, up 33 per cent from 18 months prior. In contrast, IBA AUM is just over $2.3 billion, growing on average 7.1 per cent per year.

This stark difference highlights a broader issue: the continued overreliance on government grants and loans positions Indigenous businesses as social programs, rather than viable commercial ventures. To foster real economic empowerment, there needs to be a shift in perception by the investment ecosystem, one that recognises Indigenous businesses as investable and scalable enterprises capable of driving growth and innovation.

To genuinely foster economic empowerment, the investment ecosystem must rethink how it engages with, and invests in, Indigenous businesses. Australia has 34 active angel networks, managing portfolios of over 350 companies and $600 million in funding, a clear opportunity to bridge the investment gap. These networks can embed Indigenous business frameworks into their programs, offer tailored mentorship, ensure Indigenous representation, and create clear pathways for Indigenous entrepreneurs to access early-stage capital.

Similarly, Australia's 234 accelerator and incubator programs, supporting more than 2,400 companies, must play a role. It is simply not enough to have just one Indigenous-focused angel syndicate and accelerator. Every syndicate and accelerator has unique capabilities and resources to offer, and all must contribute to advancing Indigenous entrepreneurship and self-determination.

Investment firms at all stages of the business lifecycle must also commit to including Indigenous businesses within their portfolios, continuously adapting their investment criteria to reflect the unique structures of Indigenous businesses.

And finally, banks have a key role to play, developing flexible lending models that move beyond traditional collateral requirements and providing dedicated Indigenous banking teams who understand the specific needs of Indigenous entrepreneurs and businesses. Westpac and Commonwealth Bank have taken early steps in this direction.

These steps are key to changing how investors view Indigenous entrepreneurs, shifting perception and turning Indigenous businesses from invisible to investable. No longer seen as social programs, but as scalable, high-growth enterprises driving innovation and economic growth. Once implemented, these efforts could pave the way for a milestone moment, the listing of Australia's first Indigenous-owned business on the ASX. An achievement that would signal true progress toward Indigenous economic empowerment and self-determination.

Alex Sanderson is a Business Contributor of the Indigenous Business Review. He is the Founder and former President of UNSW First Nations Business Society, an Indigenous Business Coach and Advisor at Yarpa, and an Executive Education Facilitator (Indigenous Programs) at the Australian Graduate School of Management.